According to the official data of the State Tax Service of Ukraine, published on May 5, 2025, 19,162 reports on controlled foreign companies (CFCs) were submitted in 2024. The vast majority of the reports - 98% - were submitted by individuals, which indicates an increase in awareness and responsibility among Ukrainian controllers. The CFC reporting statistics for 2024 confirm that more and more Ukrainians are complying with tax legislation.

Compared to previous years, the number of reports remains consistently high. We would like to remind you that in our previous article we analyzed in detail the statistics for 2022-2023, when the total number of reports amounted to more than 39 thousand.

In total, for the three reporting years - from 2022 to 2024 - the STS received 58,220 CFC reports. This confirms that the CFC reporting mechanism is gradually taking root in the Ukrainian tax system, and the new rules are no longer a novelty, but part of the reality for Ukrainian taxpayers.

CFCs in numbers: who reports and where Ukrainians register foreign companies

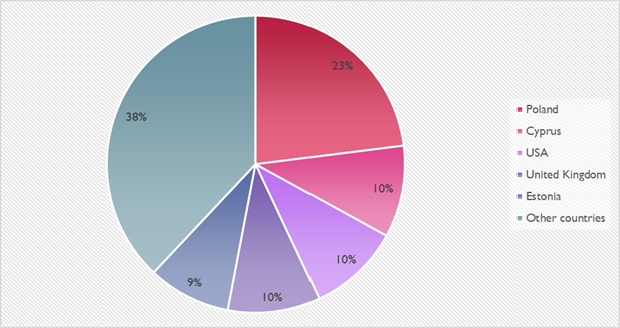

The most popular countries among Ukrainians are:

The above data demonstrates that Ukrainian businessmen actively choose to register companies in prestigious and popular EU jurisdictions, as opposed to offshore companies. The CFC reporting statistics for 2024 also indicate a reorientation of business towards transparent legal environments with a predictable tax burden.

How much will CFC controllers pay in taxes?

In 2022-2024, based on the results of CFC reporting, more than UAH 4.9 billion of tax liabilities were determined to be paid, of which UAH 2.9 billion - for 2024 alone. Nowadays, this is a significant contribution to the revenues of the state budget of Ukraine and stabilization of the economy."

Important: if you have submitted a shortened CFC report, do not forget to submit a full one by the end of 2025!

- Please note that controllers who have submitted a shortened form of CFC report together with a tax return are obliged to submit a full CFC report with all the necessary financial information and documentation by December 31, 2025.

- In case of errors, you can use the right to self-correction in accordance with subparagraph 69.38 of paragraph 69 of subsection 10 of Section XX "Transitional Provisions" of the Tax Code of Ukraine.

Services for the preparation of CFC reports from Maira Consult

Preparation and submission of reports on controlled foreign companies is a responsible process that requires a deep understanding of tax legislation. Our team of lawyers and financial advisors at Maira Consult will help you:

- Determine whether you have an obligation to report on a CFC

- Prepare a shortened or full report

- Analyze the financial statements of a CFC

- Provide support in correcting errors

- Optimize tax liabilities within the current legislation

Do you have any questions about CFCs? Don't delay - contact Maira Consult today.