In the first half of 2024, the first campaign for reporting on controlled foreign companies and submission of relevant reports by CFC controllers to the Ukrainian tax authorities was completed.

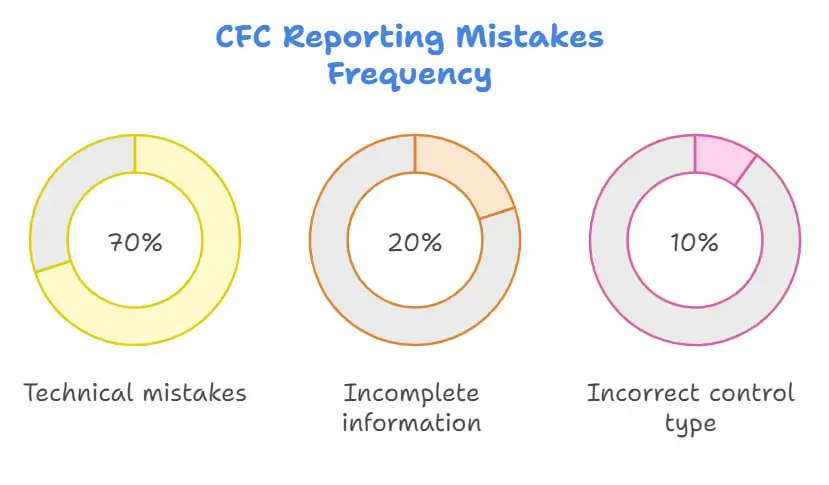

Based on the results of this campaign, the Ukrainian tax authorities identified a number of peculiarities in the reporting of controlled foreign companies and a number of typical mistakes made by controllers.

Key mistakes in reporting on CFCs

The tax authority identified the following technical errors in the preparation of the reports, including incorrect definitions:

- Type of control;

- country code of the foreign company;

- code and name of the reporting currency of the CFC;

- weighted average official exchange rate of the National Bank of Ukraine;

- the company's financial year;

- incomplete or missing transactions with non-residents;

- incorrect calculations of adjusted profit;

- calculation of profit;

- lack of information on the amount of CFC's profit received from a permanent establishment;

- no reflection of transactions with non-residents - related parties.

What is the reason for so many mistakes in the preparation of CFC reporting?

According to the experience of Maira Consult specialists, mistakes were made as a result of:

- lack of clear explanations from the tax authorities on how to fill in reports on controlled foreign companies

- lack of sufficient established practice in this area.

The most frequent problems arose with the definition of the financial year, transactions with non-residents, and transactions with related non-residents that should be reported.

Moreover, due to the change in the position of the tax service regarding the reporting of CFC transactions with non-residents, which occurred only a few days before the reporting deadline, not all taxpayers had time to analyse the CFC transactions with counterparties to determine the transactions that could be included in the reporting.

In our opinion, this resulted in the failure to include such information in the CFC reporting, which in turn may be interpreted by the tax authorities as a violation of the taxpayer's reporting obligations.

What problems did Maira Consult lawyers face when submitting reports to CFCs?

In addition to the points mentioned above, it is necessary to highlight another type of error, which is not of a technical nature, namely:

- determining the obligations to prepare and submit CFC reports for each of the CFC owners,

- determining the first reporting period for companies whose financial year does not correspond to the calendar year,

- determining the type of control over the CFC.

In each case, it is necessary to take a comprehensive approach to these issues and analyse the ownership structure of the CFC, the tax status of the owners, financial statements and requirements for the preparation and submission of financial statements in the country of its registration.

Not just one factor, but a whole range of factors directly affects the controller's obligations and the procedure for preparing and submitting reports on controlled foreign companies.

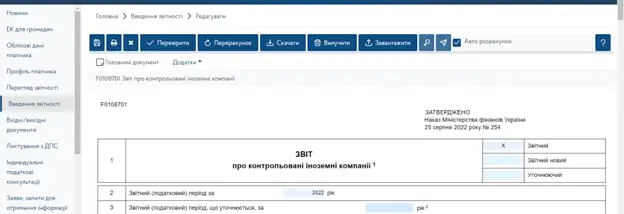

Shortened CFC Report. It is important not to miss the deadline!

We draw attention to the obligations of controllers who have submitted an abbreviated CFC report to the tax authorities, as you still have an obligation to submit a full CFC report by the end of 2024. We will assist you in submitting the full CFC report. What difficulties did you face when submitting the CFC report?

The main recommendation for clients who have CFC obligations is to take a comprehensive approach to determining specific CFC obligations for each of the foreign companies owned or controlled by them, as well as to analyse the company's activities and financial statements more thoroughly for the purposes of CFC reporting.

If you have any questions, please contact Maira Consult, which will help you with all your questions.