The American payment system Payoneer allows you to receive and send payments around the world. To date, the system is used by more than 4 million users, including individuals, sole proprietors and businesses.

Do you lose customers because you cannot open an account with a local bank in the country where you planned to do business? With Payoneer this is no longer a problem! Get customized bank details in the US, Europe, and Asia and accept payments in all currencies as if you were operating in the local market.

Every year, the number of Payoneer users is increasing, as no competitor can provide similar services to customers. So what is the success? Payoneer has its own style and as the founder Yuval Tal noted the biggest challenge for him in creating a payment system was:

"Finding the right people and getting them to work together to achieve synergy."

Benefits of opening a free business account with Payoneer

Opening a business account with Payoneer is an easy way to optimize financial transactions for entrepreneurs operating in the global market. Maira Consult lawyers highlight the following benefits for clients when working with Payoneer:

1. Free Payoneer for business

Registering a business account with Payoneer is free of charge. This allows entrepreneurs to start working without additional financial investments, which is especially important when starting a business.

2. Accounts in different currencies

The service supports multicurrency, which makes it possible to receive payments in the most common currencies - USD, EUR, GBP, JPY, AUD, and others. This feature is perfect for businesses focused on an international audience.

3. International transfers without borders

Recieve funds from partners and clients from anywhere in the world via bank transfers. This process is as simple and convenient as possible.

4. Quick access to funds

You can quickly transfer money to your local bank account or withdraw cash using Payoneer MasterCard at any ATM.

5. Integration with large and popular marketplaces

Payoneer easily integrates with platforms such as Upwork, Fiverr, Amazon, eBay, and others. This simplifies the process of earning money for freelancers and entrepreneurs.

6. Save money on international transactions

Take advantage of Payoneer's low fees to avoid high international payment costs. This is especially beneficial for businesses with a large volume of foreign operations.

7. Convenient financial tools

The platform interface allows you to control payments, issue invoices, make mass payments, create a business network to automate your business operations.

8. Global network of partners

With Payoneer, you can easily establish business connections and exchange payments with partners around the world.

9. Reliable protection of financial transactions

Payoneer provides a high level of data and transaction security, which guarantees peace of mind and confidence in your finances.

10. Mobile app for account management

Manage your account from anywhere through a convenient mobile app. You can track transactions, receive alerts, and manage your finances in real time.

As Payoneer is constantly improving its service and introducing new services for customers, we offer you detailed instructions on how to register a business account yourself in 2025.

Steps for registering a free Payoneer account for business.

Starting to register a business account on your own. Click on the Link to the official Payoneer website.

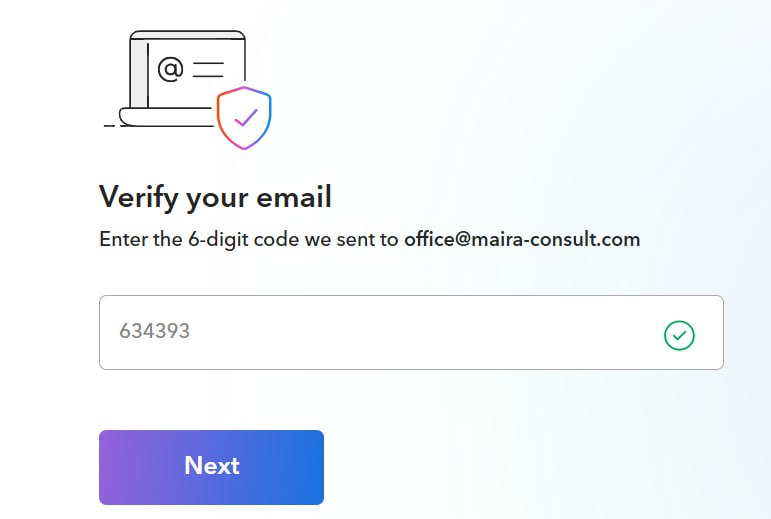

The first step is to confirm your email, to which you will receive an activation code.

It takes 30 seconds to receive and enter the code, so you should be very careful.

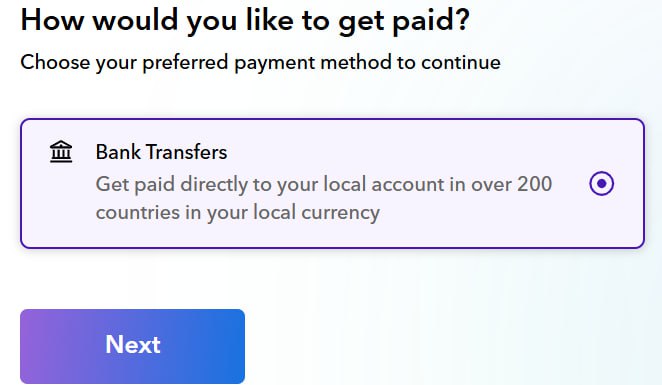

After entering the confirmation code, a window will open asking you how you want to receive funds to your Payoneer account. You should select the Bank Transfer option.

Now we move on to the next step - providing business information about the account.

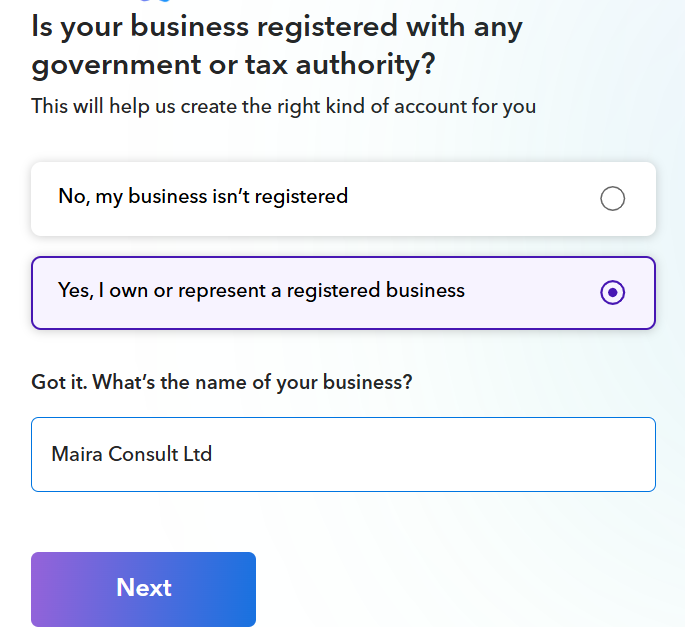

Since this is an instruction on how to open a Payoneer business account on your own, you need to select the option - Yes, I am the owner or representative of a registered business and enter the company name.

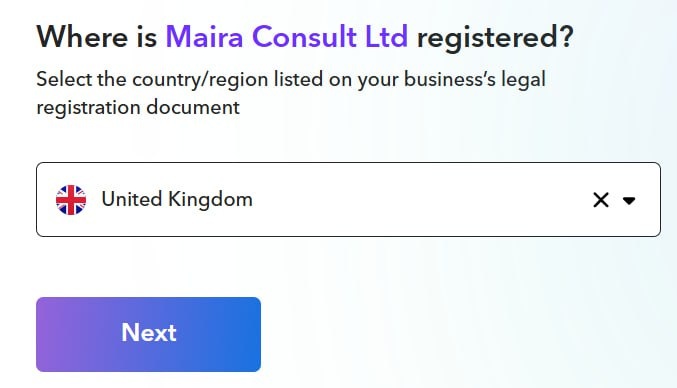

Next, you need to select the country of registration of the company from the list.

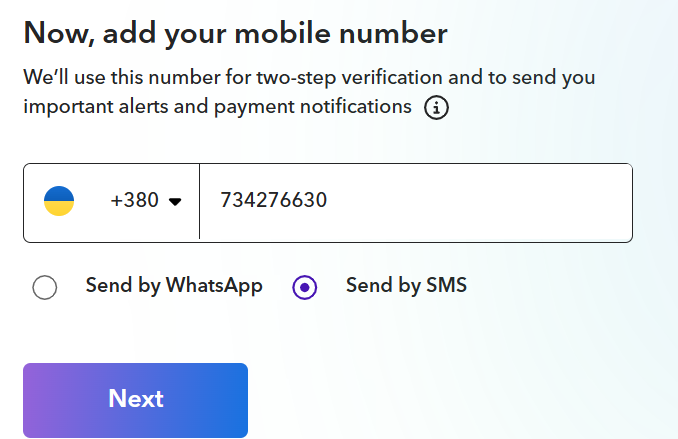

Please provide a contact phone number. To confirm the phone number, click Send verification code via Whatsapp or SMS.

Enter the received code in the verification code field.

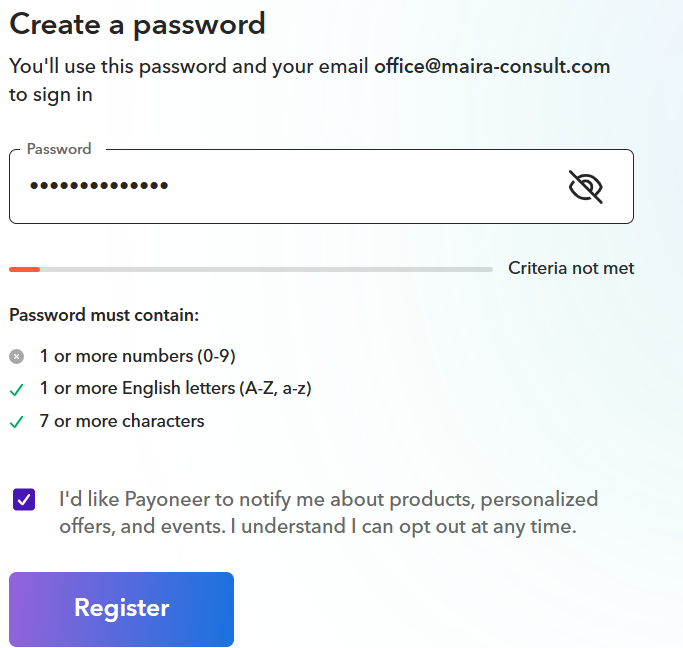

Create a password. The password must contain at least 7 characters, of which at least 1 or more Latin letters (A-Z, a-z) and 1 or more numbers (0-9) must be included;

Business account in Payoneer is registered.

The next step is to provide detailed information about the company's activities and its corporate structure.

Select the industry or field of activity that most closely matches the company's main activity. Answers must be selected from the list.

Which of the following best describes how your business usually receives funds?

Marketplaces (Amazon, Facebook, eBay, Upwork, etc.) where you sell goods or services to customers

Companies you work with (clients, remote employers)

Customers who pay directly through a physical store or online store on the website

How many transactions do you average per month?

0-20

21-50

51-100

101+

None yet, business is just starting

What is the average total volume of these transactions per month (in US dollars)?

You can provide an approximate amount.

Under $500

$501 - $2,500

$2,501 - $10,000

$10,001 - $50,000

$50,001 - $250,000

Above $250,000.

The next step is to provide information about the company.

Fill in the company data in English letters only.

Company type (select from the drop-down list: LLC, FOP, Corporation, Partnership, etc.);

Company registration number;

Legal name of the company according to the registration certificate;

Trading name of the company, which you use to conduct business;

Date of registration.

Enter the legal address of the company. You must specify the country, street and house number, city, postal code.

If the legal address does not match the actual business address, you must additionally specify the business address.

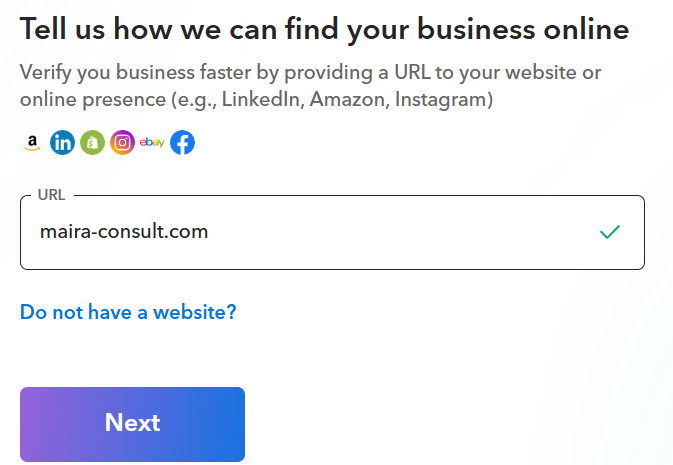

Enter the company's website. If you don't have one, you can provide a page that offers your products or services or specify nowebsite.com;

Indicate the region where you operate.

Enter the details of the authorized representative of the company:

First and last name

Date of birth

Citizenship

Residence address:

This must be your permanent residence address. Payoneer will verify it during account verification.

Country/Region

Street and house number

City/Town

Postal code/ZIP code

Also required:

Passport or ID card details

Country of issue

Date of issue

Date of validity

First and last name in the local language (exactly as it appears in the document).

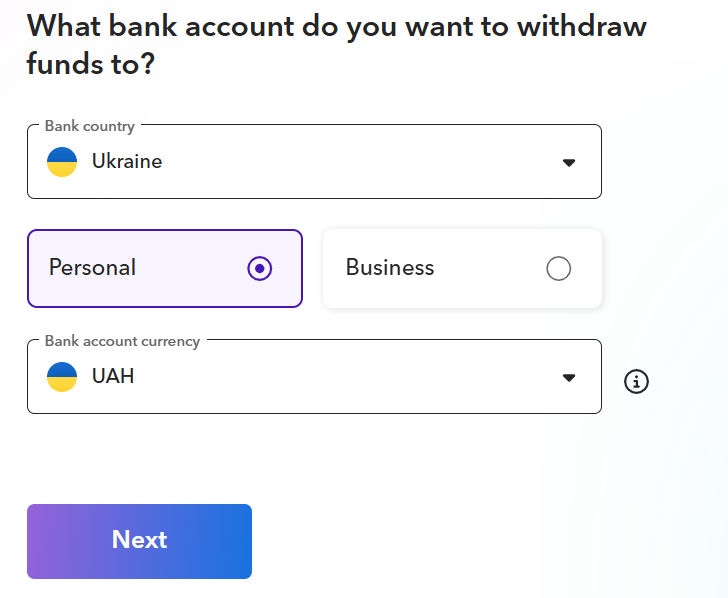

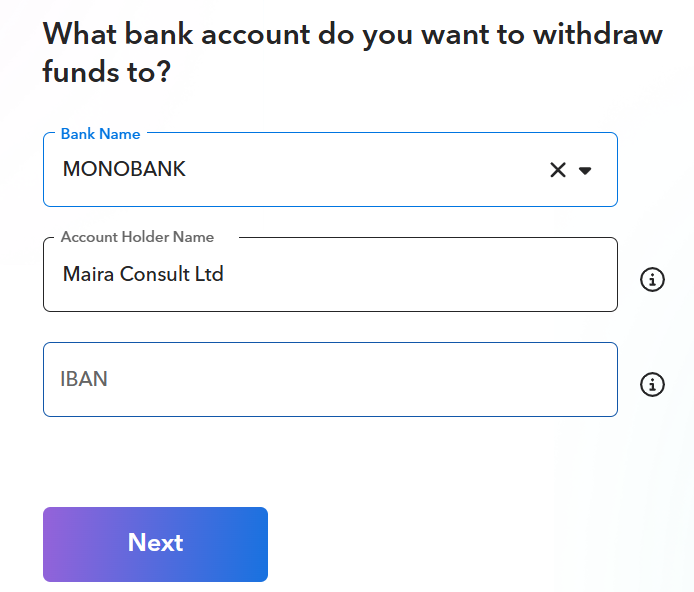

Confirmation of the account availability.

Select the country of the bank;

Select the type of account for withdrawal: personal account or business account;

Select the account currency;

Select a bank from the drop-down list;

Enter the name of the official bank account holder;

Enter the IBAN.

If you are specifying a personal account instead of a company account:

Make sure that the account holder's name matches the bank data exactly;

If you receive a message about a name mismatch, select the reason UBO/Director.

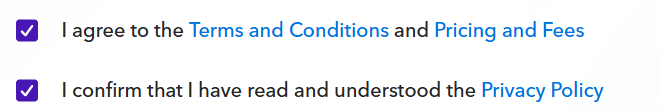

The last step in registering a free account is to agree to the terms and conditions, privacy policy, and tariffs.

It is important to note that creating an account with Payoneer is not an actual account opening.

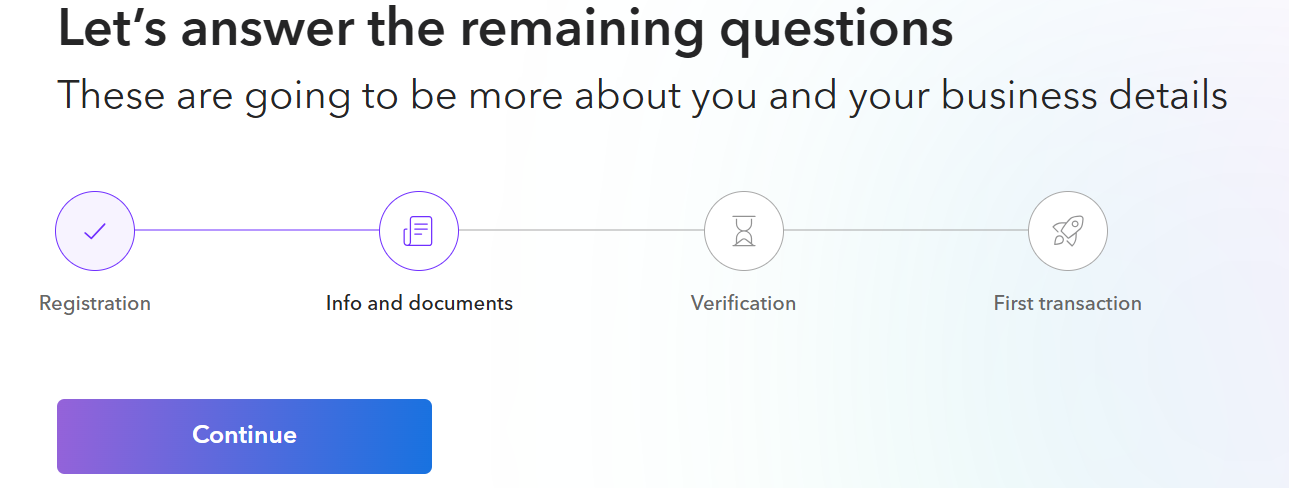

How to verify a free Payoneer account for business

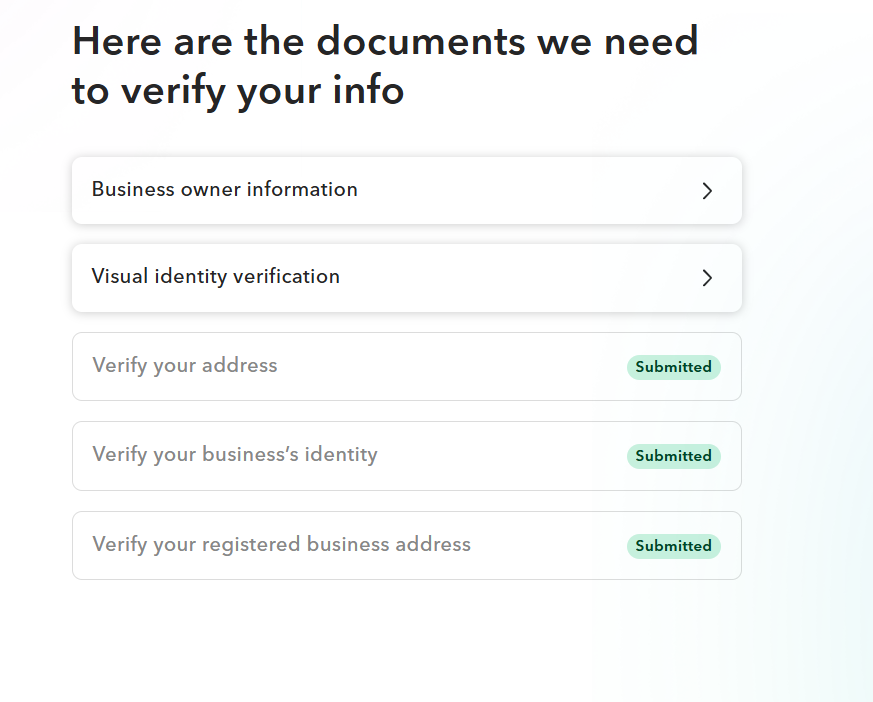

Complete registration of all stages of Payoneer business account does not constitute final account opening. After registering a free Payoneer for business, you need to log in using your login (email) and password and upload the basic documents.

Business Owner Information

Need to provide information on all participants in the company:

Passport or ID card of the owner/director (color scan or photo)

Contact details (phone, email)

Visual Identity Verification (Visual verification of the company owner or account manager)

Pass video verification (at the request of the system)

Verify Your Address (Confirmation of residence address)

Provide proof of residence address (utility bill / bank statement not older than 3 months)

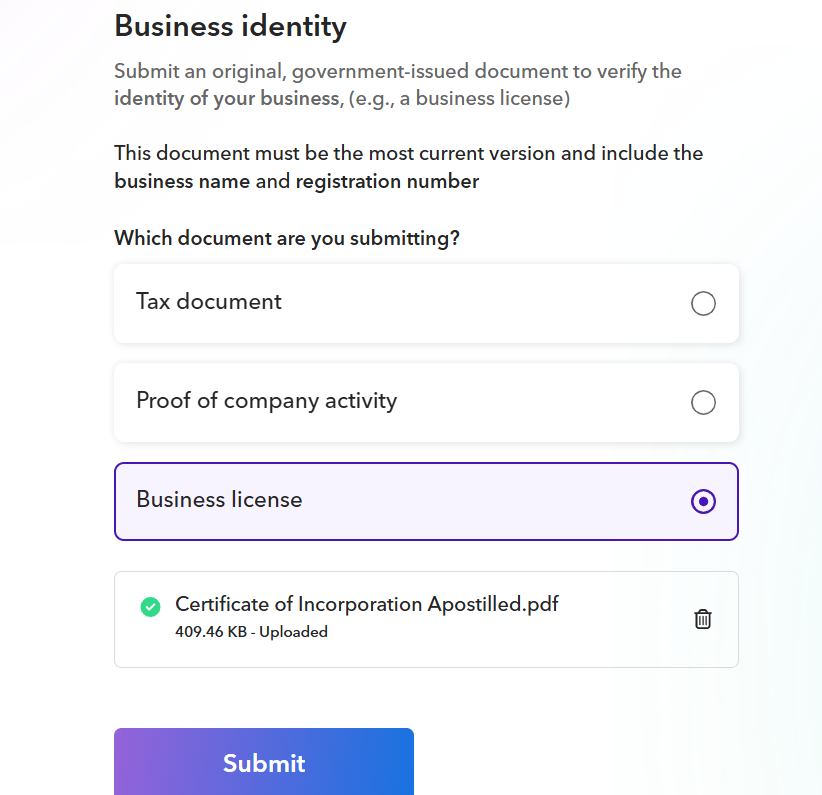

Verify Your Business's Identity (Confirmation of business registration)

Provide for the company:

Excerpt from the Trade Register / Certificate of Incorporation

Articles of Association

Document of appointment of director

Register of shareholders (if applicable)

Verify Your Registered Business Address

Provide a current certificate with a legal address or Utility bill for the company.

The verification center may open requests for documents and fill out questionnaires about the company's activities, structure, and owners.

After reviewing all the documents and opening a free Payoneer account, you will receive a notification that your Payoneer account has been opened.

Standard list of documents for opening a free business account with Payoneer:

Company registration certificate

Share certificate

Proof of company address

Founding agreement and Articles of Association

The ownership structure of the company - is a new requirement of Payoneer, the document must be certified by a notary/attorney/lawyer/director or CEO of the company. This document is similar to the Certificate of Incumbency and contains detailed information about the company name, registration number, company address, director, shareholder, share capital and share distribution. As a regular partner of Payoneer, Maira Consult has many years of experience in preparing such documents and provides professional assistance to ensure full compliance. If you need to prepare this document or have any other questions, don't hesitate to contact us - we are ready to help you at every stage!

Documents confirming the company's activities (invoices, contracts, etc.)

Foreign passports of all participants

Document confirming the address of the participants (utility bill or bank reference from a personal account)

Document confirming bank account of the beneficail owner and the company

Selfies of all participants with a passport and the current date

Other documents depending on the company's activities and structure.

Activation of Payoneer business account

The final step to verify free Payoneer for business is to confirm the bank account for withdrawal.

Payoneer payment system offers two types of bank account verification:

verification by sending microdeposits

providing a bank statement

The most popular type of verification is account verification by sending microdeposits. In this case, Payoneer sends two microdeposits to your personal or corporate account specified during the registration of a business account. According to our experience, these are the amounts of 0.12, 0.15 USD.

After the micro deposits are credited, you need to enter these amounts in the verification center. If the amounts sent by Payoneer and the amounts you entered in the verification center match, your withdrawal account will be automatically verified.

Current Payoneer fees for business accounts

Below are the main fees that apply to companies from Ukraine and the EU.

The current Payoneer fees in 2026 depend on the type of transaction, currency, and recipient country. Below are the main fees for Payoneer business accounts that apply to companies from Ukraine and the EU.

Transaction/Service | Fee or Commission | What it means for business |

|---|---|---|

Opening a business accountbusiness account | Free | Registration of a company or sole proprietorship does not require start-up fees no start-up fees |

Annual Account Fee | $29,95 USD - if the account is inactive or the minimum turnover is not reached within 12 months | Active businesses usually do not pay this fee |

Receiving payments from other Payoneer customers | 0 % | Internal transfers between accounts without fees |

Receiving funds via local details (EUR, GBP, etc.) | Usually free of charge | Works like a local bank account; minimum amounts may be restricted |

Recceiving USD via ACH (USA) | Free | No commission for domestic bank transfers in the USA |

Receiving USD via Wire (SWIFT) | Up to 1% | Depends on the type of international Depends on the type of international transfer |

Payment of invoices by bank card (Request a Payment) | Up to 3,99 % + $0,49 USD | Commission is applied when paying the invoice by Visa/Mastercard |

ACH-.debit (USA) | About 1% | Automatic debiting from the client's account |

Outgoing Payoneer → Payoneer (international) | About 1% (minimum fee may apply) | Transfers between business accounts in different countriesbetween business accounts in different countries |

Outgoing Payoneer → Payoneer payments (within the same country) | Fixed fee (approximately $4 / €4 / £4) | Depends on currency and jurisdiction |

Transfer to an external bank account (SWIFT) | Up to 3% | Fee depends on currency, country and the amount of the transfer |

Withdrawal of funds in the same currency to a local account | About 1-1,5 (USD/EUR/GBP) per transaction | Local bank transfer without conversion |

Currency conversion within the account | Up to 2-3,5 % margin to the market rate | The main cost item when working with different currencies |

Annual fee for the Payoneer Mastercard | $29,95 USD (if the card is activated) | Charged for using a business card |

Cash withdrawal via ATM | 3.15 USD / 2,50 EUR / 1.95 GBP per transaction | Automated teller machine fees and currency conversion may apply |

Exact rates may vary depending on:

country of account registration;

business type;

company turnover;

individual terms of cooperation.

How to withdraw money from Payoneer

Payoneer allows you to transfer funds to your local bank account conveniently or use your Payoneer card to withdraw money from ATMs.

Withdrawal to a bank account in local and non-local currency from Payoneer balance - fee up to $3 per transaction (depending on the amount). Withdrawal via Payoneer Mastercard.

Use the card to withdraw money from ATMs.

You can withdraw cash in local currency from ATMs in any country.

Check the cash withdrawal fee (usually $3.15 per transaction).

Transfer to another Payoneer account.

If your partner also uses Payoneer, you can transfer funds to their account for free.

VIP account in Payoneer in 2026

Starting January 1, 2025, new customers can get VIP status if they receive at least $30,000 per month to their Payoneer account.

Each new VIP account will be supported by a personal manager for the first three months. During this period, the client and the VIP manager will:

Successfully pass the verification process;

Conducts the first transactions;

Gets acquainted with all stages of working with the account, payment cards and details for the full use of all services.

After completing this stage, the client retains VIP status, which includes special rates and access to a premium support channel.

Advice from Maira Consult experts: opening a Payoneer account for business

Our specialist Maryna Taranets, who is engaged in opening an account with Payoneer, recommends you to prepare all the necessary documents in advance before registering an account. This will allow you to save time and not interrupt the account registration process.

We recommend uploading high-quality passport photos, not scanned copies, so that the system can recognize the passport.

Please specify only a valid email to which you have constant access during registration.

Save not only your login and password, but also remember the secret question and its answer, as well as the Recovery code, which is unique.

Regularly check the verification center in your personal account, as new requests from compliance may appear there.

Even if the company is newly established and does not yet have an account, prepare signed contracts with future partners. This will allow compliance to understand your intentions.

After you start working with Payoneer, check exchange rates, choose banks with minimal fees, and make transfers on business days to avoid delays.

Opening a free business account with Payoneer is the best solution for entrepreneurs and freelancers looking to save time, reduce their costs, and automate international payment management. Maira Consult has many years of experience with opening an account in payment systems and is a regular partner of Payoneer. We will help you at all stages - from registration to full customization of your business account!