Despite the challenging security situation caused by the full-scale aggression of the russian federation, Ukraine continues to demonstrate remarkable economic resilience and remains an attractive market for foreign investors. Thanks to ongoing reforms in corporate law, streamlined company registration procedures, and the rapid growth of key industries, Ukraine offers unique opportunities for establishing a business.

The legal team at the international firm Maira Consult has prepared a comprehensive guide for foreign investors on how to register a company in Ukraine - in particular, a limited liability company (LLC), and what factors to consider to ensure a successful market entry. For those planning to launch a business and register an entity in Ukraine, this material serves as a valuable resource, even in the face of the current wartime challenges.

Why Invest in Ukraine?

Ukraine remains a promising and dynamic market due to the rapid development of several key industries that actively attract foreign capital. The following sectors currently present the most significant investment opportunities:

- Defense Sector. Large-scale government programs focused on modernization and the development of security technologies are creating favorable conditions for foreign companies to establish operations in this field.

- Public Procurement. Infrastructure reconstruction projects, supported by international partners, offer substantial prospects for construction and engineering service providers.

- Humanitarian Projects. Foreign companies are increasingly participating in the rebuilding of schools, hospitals, and other essential public facilities.

- Agribusiness, Logistics, and Renewable Energy. These sectors are demonstrating stable growth, even under wartime conditions, due to strong government support and the involvement of international investors. Registering a business in Ukraine allows for full participation in these vital areas.

One of our clients - an international company based in the United Kingdom that specializes in demining operations, private security services, and cybersecurity successfully launched its operations in Ukraine. We assisted in designing an optimal corporate and governance structure tailored to the client's global network of offices. An LLC was incorporated in Ukraine, and comprehensive legal support was provided, including on regulatory matters such as obtaining special permits and licenses necessary for lawful operation in the country.

Investing in Ukraine means not only participating in the country's recovery but also developing a profitable and forward-looking business.

Advantages of Registering an LLC in Ukraine

For foreign investors planning to operate in Ukraine, the most commonly used legal form is the Limited Liability Company (LLC). This structure is ideally suited for active commercial operations, asset protection, and flexible corporate governance - particularly if you intend to establish a new business or set up an LLC from scratch in Ukraine.

- Fast Company Registration: The process of incorporating an LLC typically takes 2-3 business days.

- Limited Liability: Shareholders are liable for the company's obligations only to the extent of their capital contributions.

- Flexible Financing Options: Share capital may be funded either directly as an equity or through intercompany loans from the parent company.

- Transparent Tax System: The corporate income tax rate is 18%, while withholding tax on outbound payments can be reduced under applicable double taxation treaties (DTTs).

- Alignment with EU Standards: Ukrainian corporate legislation is being actively harmonized with European Union norms, making the jurisdiction particularly attractive to EU-based investors.

- Group Structure Compatibility: An LLC may operate as an independent business entity or as part of a holding or group structure, offering strategic flexibility.

Registering an LLC is the optimal solution for foreign companies aiming to initiate operational activities in Ukraine. This legal form enables a quick market entry, ensures legal clarity, and meets Ukrainian requirements for transparency of ownership structures.

Key Considerations for Foreign Investors

While establishing a business in Ukraine offers numerous advantages, there are several important legal and regulatory aspects that foreign investors should take into account:

- Disclosure of Ultimate Beneficial Owner (UBO). In accordance with the Law of Ukraine "On Prevention and Counteraction to Legalization (Laundering) of Proceeds from Crime", during the company registration it is required to disclose accurate and up-to-date information on their ultimate beneficial owner. Failure to provide such information, or providing false or incomplete data, may result in fines (for instance, up to UAH 51,000 as of 2025).

- Ownership Structure Disclosure for Foreign Founders. If the founding shareholder of an LLC is a foreign legal entity, the full ownership structure up to the ultimate beneficial owner must be disclosed. This structure must be supported by official documentation, such as an extract from the relevant foreign company register, which must be apostilled (or legalized, as applicable) and accompanied by a certified translation into Ukrainian.

- Employment of Foreign Nationals.To employ foreign nationals in Ukraine, it is mandatory to obtain a work permit.

It is particularly important to note that a foreign individual may not act as the director of an LLC prior to obtaining a valid work permit. This is one of the most common oversights made by foreign investors intending to incorporate an LLC in Ukraine.

Who Can Be the Founder and Director of an LLC in Ukraine?

- Founder. Any individual or legal entity, whether a resident or non-resident of Ukraine, may act as the founder (shareholder) of a limited liability company in Ukraine.

- Director. The position of director may be held by:

- a Ukrainian citizen;

- a foreign national holding a permanent residence permit in Ukraine;

- a foreign national who has obtained a work permit (but not before the permit is issued).

Important: The Nominee Director in Ukraine Is a Myth

There is a common misconception among foreign investors about the possibility of using a "nominal director" in Ukraine - a person who is formally listed as the company's director but does not actually participate in its management. This practice is prohibited under Ukrainian law. The legislation directly imposes personal responsibility for the company's activities, payment of taxes, reporting and compliance with legal norms on the director of a legal entity. Therefore, it is possible to open a company in Ukraine only with a real director.

In 2025, a European company specializing in the manufacture of medical devices successfully launched a project to enter the Ukrainian market. As part of this initiative, a comprehensive legal analysis was conducted for the client, covering various options for structuring corporate presence in Ukraine, tax planning strategies, and regulatory aspects related to product certification, logistics, and the distribution of goods within the country. Particular attention was devoted to the company registration process in Ukraine, taking into account the chosen business model, the most suitable legal form of ownership, and the legal requirements applicable to foreign shareholders.

Taxes, Salary and Share Capital

Salary

As of January 1, 2025, the minimum monthly salary in Ukraine is UAH 8,000. The applicable payroll taxes include:

- Personal Income Tax (PIT): 18%

- Military levy: 5%

- Unified Social Contribution (USC): 22% (paid by the employer)

Share Capital

- There is no statutory minimum share capital requirement for an LLC.

- The capital may be contributed in monetary or non-monetary form (e.g., property, securities, etc.).

- Contributions must be made within 6 months of the company's registration.

- The capital may be used for any lawful business purpose of the company.

Beneficiaries

When incorporating an LLC in Ukraine, one of the core legal requirements is ensuring transparency of the ownership structure. Ukrainian law mandates full disclosure of the company's ownership chain - from parent companies to the ultimate beneficial owners (UBOs), who must be identified as natural persons. Failure to disclose the ownership structure in full will render the company registration process impossible.

Constitutional Documents

The principal document governing an LLC is its Articles of Association (Charter), which outlines the internal governance and operational rules of the company. The Charter may include provisions on:

- Limitations on the powers of corporate management bodies;

- Decision-making procedures and voting rules;

- Pre-emptive rights to purchase shares or restrictions on their transfer to third parties;

- Any other provisions regulating internal management and relations between shareholders.

Corporate Governance Structure

- General Meeting of Shareholders. This is the supreme governing body of the LLC, responsible for making key decisions. In the case of multiple shareholders, the Charter may establish voting procedures and thresholds.

- Executive Body. The LLC's day-to-day operations may be managed by a sole executive officer (director) or a collegial executive body, such as a board or directorate.

- The supervisory board, if provided for by the charter, performs the functions of monitoring the activities of the executive body.

- The Charter may also prescribe detailed rules on the functioning of the executive and supervisory bodies, decision-making processes, and limitations of powers. For instance, placing restrictions on certain transactions can be an effective mechanism for protecting the interests of shareholders.

When deciding to establish a business in Ukraine, foreign investors should carefully consider these aspects of corporate governance to ensure a transparent ownership structure and stable business operations in full compliance with Ukrainian legislation.

Modern Tools for Governance and Protection in an LLC

Shareholders' Agreement - an Effective Mechanism for Corporate Management

During the incorporation and operation of a limited liability company (LLC) in Ukraine, shareholders may choose to enter into a corporate agreement (commonly referred to as a shareholders' agreement) - a legal instrument that enables detailed regulation of the internal relationships between co-owners of the company.

Shareholders' Agreement may be concluded not only between the LLC shareholders themselves, but also with the participation of the company or third parties. A shareholders' agreement may regulate critical matters such as:

- decision-making procedures,

- financing arrangements,

- governance and control mechanisms,

- and other essential aspects of cooperation between the parties.

Widely used in many jurisdictions, this tool is gaining increasing popularity in Ukraine due to its flexibility and its capacity to provide transparency, stability, and predictability in corporate affairs. More and more foreign investors planning to open a company in Ukraine are preparing a draft corporate agreement in advance as part of their business structuring.

Irrevocable Power of Attorney: A Reliable Protection of Shareholders' Interests

An irrevocable power of attorney is a specialized corporate law instrument frequently employed to ensure the fulfillment of obligations under corporate agreements. Such a power of attorney is granted by the LLC participants within the framework of agreements concerning their shares in the share capital or related powers, and it cannot be revoked unilaterally by the principal.

This mechanism is widely used in countries with Anglo-Saxon legal traditions (such as the United Kingdom or the United States) and serves as an effective tool to protect the rights and interests of the parties, ensuring the continuity of agreed arrangements. It is advisable to consider implementing this instrument at an early stage, particularly during the process of registering an LLC in Ukraine, especially for companies with a complex management structure or a large number of shareholders.

Registration of LLC Shares in the Central Securities Depository: A New Level of Security

Under current Ukrainian legislation, after company registration LLC participants have the option to transfer the registration of their shares to the Central Securities Depository, thereby foregoing the traditional method of recording changes through state registrars or notaries.

This approach guarantees secure custody and full control over share transactions, as any modifications can only be effected through the depository system. Consequently, it significantly reduces the risk of fraudulent actions and enhances the transparency of the corporate ownership structure.

Additionally, the depository model enables access to advanced legal instruments, including:

- Escrow agreements concerning shares;

- Share blocking mechanisms;

- Automatic transfer of ownership rights over corporate rights in accordance with contractual terms.

This framework not only strengthens investor protection but also facilitates the fulfillment of contractual obligations among LLC participants.

Financing of LLC

After company establishment to cover start-up costs (salaries, rent, legal and accounting services), the following financing options are possible:

- Loan from the Parent Company. This option enables the LLC to receive funds promptly to support its operations.

- Contribution to Share Capital. Participants may contribute capital, including in foreign currency, to form or increase the company's authorized capital.

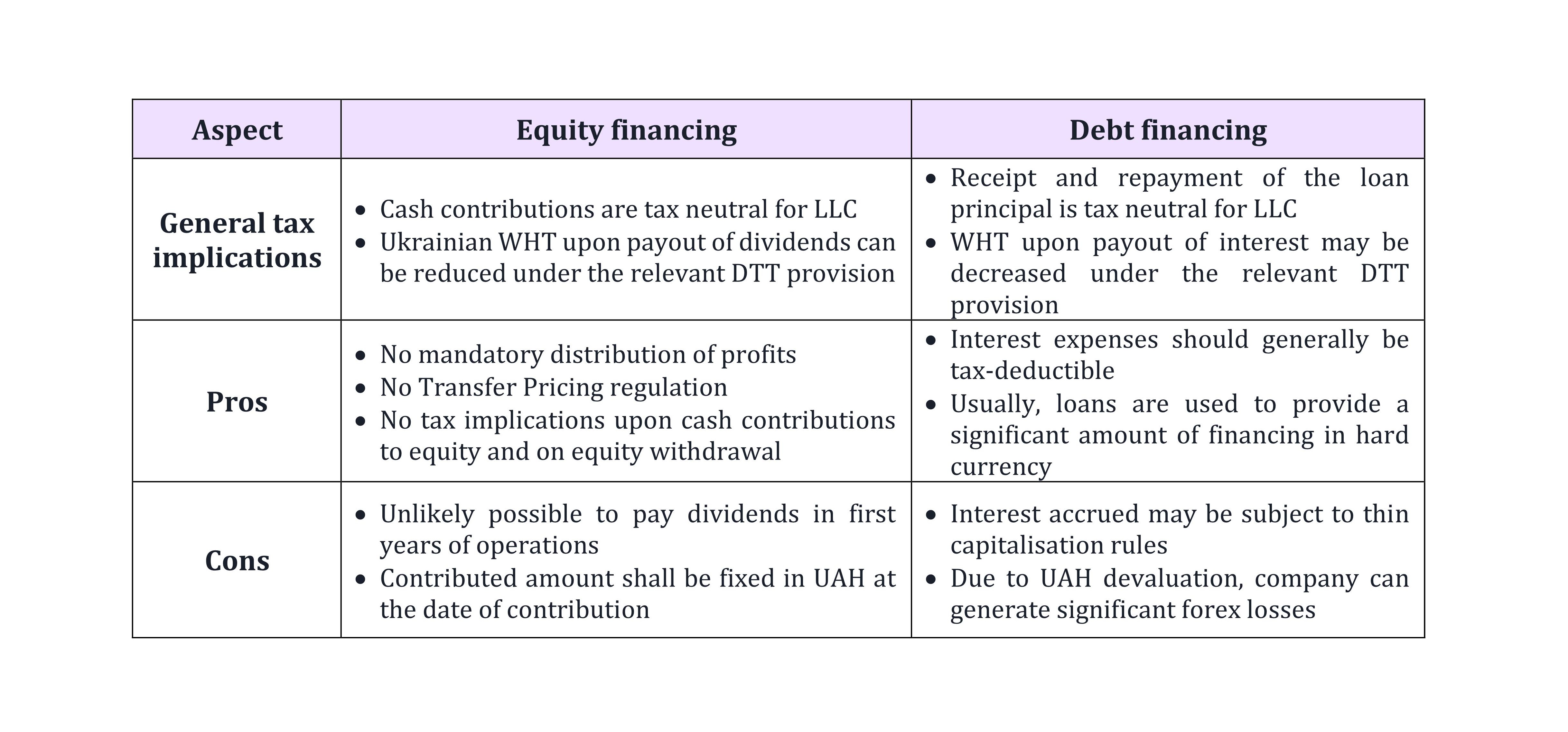

Comparison of LLC Financing Options in Ukraine

Equity financing

General tax implications:

- Cash contributions are tax neutral for LLC

- Ukrainian Withholding Tax upon payout of dividends can be reduced under the relevant DTT provision

Advantages:

- No obligation to distribute profits among participants.

- Contributions to the share capital are not subject to Transfer Pricing Rules.

- Return of contributions to participants is generally non-taxable (subject to specific circumstances).

Disadvantages:

- During the initial period of the LLC’s operation, the company typically lacks the ability to promptly distribute profits as dividends.

- The amount of the contribution is fixed in Ukrainian hryvnia on the date of contribution, which creates currency risk for foreign investors.

Debt Financing

General tax implications:

- Receipt and repayment of the loan principal is tax neutral for LLC

- WHT upon payout of interest may be decreased under the relevant DTT provision.

Advantages:

- Interest expenses may be included in tax-deductible costs, thereby reducing the taxable profit.

- Enables raising substantial amounts of funding, including in foreign currency.

Disadvantages:

- Interest payments may be subject to thin capitalization rules and related limitations.

- Currency fluctuations may result in losses due to depreciation of the Ukrainian hryvnia.

How a Foreigner Can Register an LLC in Ukraine: Step-by-Step Procedure

Registering a company in Ukraine, particularly an LLC, for a foreign investor is a process that requires careful preparation of constitutional documents, consideration of corporate structure nuances, and strict compliance with Ukrainian legal requirements.

In practice, the preparation of incorporation documents involving a foreign company usually takes 3 to 5 business days. However, this timeframe may be extended if the corporate group structure is complex or if multiple jurisdictions are involved in the ownership chain.

Define the Corporate Structure

- Determine the number of founders (participants), their residency status, and the format of the management body (e.g., sole director or board of directors).

- Determine the legal address of the company.

- Decide on the appointment of a director for the period of company registration - it can be a foreigner with a permanent residence permit or a citizen of Ukraine.

Preparation of constitutional documents

- Resolution of the parent company approving the establishment of the LLC;

- Notarized and apostilled copies of the passports of the ultimate beneficial owners of the LLC (those holding 25% or more);

- Notarized and apostilled copy of the parent company's certificate of incorporation (extract from the relevant commercial or court register);

- Power of attorney from the parent company authorizing local lawyers to carry out registration procedures on behalf of the LLC (notarized and apostilled);

- Resolution on the establishment of the LLC (can be executed in Ukraine based on the power of attorney issued by the parent company);

- LLC Charter (can also be executed in Ukraine under the power of attorney from the parent company);

- Company registration application form.

Important! All documents issued abroad must be officially translated into Ukrainian. This procedure can be performed in Ukraine through certified translators.

State Registration

- Submission of incorporation documents for the LLC through a notary or state registrar;

- Obtaining an extract from the Unified State Register and registration with the tax authorities (within 2-3 business days).

From the moment of state registration and tax registration, the LLC acquires the right to conduct business activities, open bank accounts, and enter into legal relations with third parties.

Opening a Corporate Bank Account

Opening a company in Ukraine is only the first step. Opening a bank account in a Ukrainian bank is a critical step to commence business operations. The choice of bank affects the convenience of financial transactions, service speed, and access to international payments. Some Ukrainian banks, such as PrivatBank or Oschadbank, maintain stricter conditions for foreign founders, which may complicate the process. Conversely, international financial institutions like Raiffeisen Bank or Citi generally offer more flexible solutions tailored for companies engaged in foreign economic activity.

Obtaining a Work Permit for a Foreign Director

- Submission of an application to the Employment Center;

- Upon receipt of the permit, the foreign national can be appointed as director and conclude an employment contract.

One of the leading American companies specializing in investments in large-scale industrial facilities worldwide has successfully implemented an investment project in Ukraine, specifically related to the construction of an industrial park. For the client, a detailed legal opinion was prepared covering corporate and tax structuring of the project, as well as regulatory requirements associated with the establishment and ongoing operation of industrial parks in Ukraine. Moreover, our team of lawyers provided comprehensive legal support throughout the entire project implementation process, including the formalization of the industrial park's creation and the resolution of operational matters.

How Can a Foreigner Establish a Company in Ukraine?

Registering a company in Ukraine offers foreign nationals a fast and convenient way to enter a promising market. Thanks to streamlined procedures, flexible legislation, and modern corporate mechanisms, Ukraine provides a favorable environment for doing business. However, in order to open a company in Ukraine, it is necessary to take into account the requirements for disclosure of beneficiaries, employment of foreigners and preparation of all corporate documents.

Despite the challenges currently faced in Ukraine, interest from foreign investors continues to grow year by year. We recommend that foreign investors engage specialized firms to assist with LLC registration, document preparation, and adaptation to the Ukrainian market. Invest in Ukraine - a land of opportunities for your business.

Contact international law company Maira Consult, and we will handle the entire legal process of registering an LLC in Ukraine for you - stress-free and with full risk management. Start investing today.