Tax Residence certificate in the UK

Most entrepreneurs who have registered foreign companies, in particular companies in the UK, have the opportunity to obtain a certificate of tax residence of their company.

What is a certificate of residence?

A certificate of tax residence is required to obtain tax benefits in another country if the company pays tax on its foreign income in the UK.

This certificate helps to confirm to another country the tax residence in the United Kingdom.

Why is it needed?

For example, the Convention between the Government of Ukraine and the Government of the United Kingdom of Great Britain and Northern Ireland for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income and on Capital Gains was signed on 10.02.1993 and entered into force on 11.08.1993.

On 09.10.2017, the Protocol amended the Convention. The conclusion of the Protocol was aimed at avoiding double taxation of income of individuals and legal entities arising in both states.

How to obtain a Tax Residence certificate in the UK?

To obtain a certificate, you need to fill out a special form and answer a number of questions from HMRC regarding the company's activities, its counterparties, confirm the place of management of the company, the residence of the owners, etc.

Please note that registering a company in the UK does not automatically entitle you to a tax residence certificate. Unlike other European countries, in the UK you need to provide arguments for the tax basis for granting a tax residence certificate to an English company.

According to HMRC's internal guidance, when an employee receives a request for a certificate of residence, he or she should first check:

The grounds on which the company should be considered to be resident in the UK, including which Double Taxation Treaty and the articles of that Treaty are applicable.

The date or period for which the client is requesting the certificate of residence.

HMRC will normally certify that a person is resident in the United Kingdom on the date the certificate is issued. However, HMRC can also certify that a person has been resident for a period of time, as long as that period does not end later than the date the certificate is issued (HMRC cannot certify that a person will be resident in the UK for any period in future as it cannot verify that this will be the case).

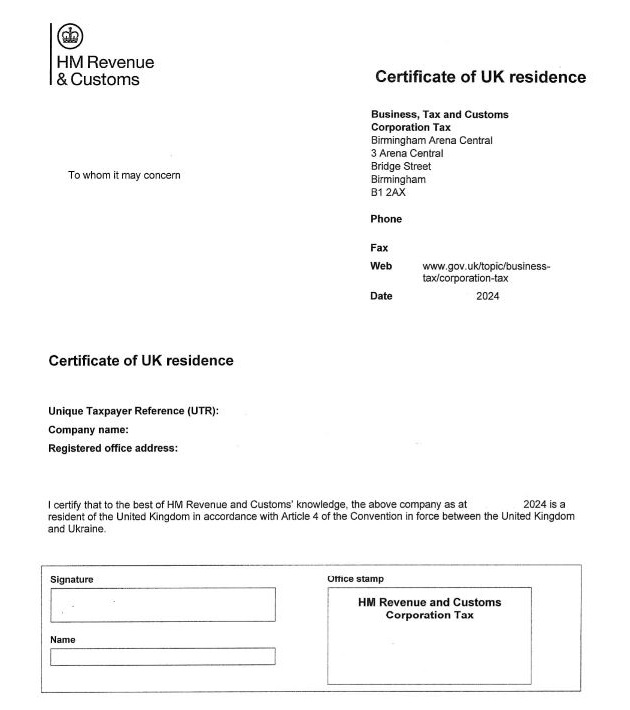

The format of the certificate may vary slightly, but it usually confirms:

- The name of the company

- The registered office

- That the company is resident in the UK for tax purposes or under a particular tax treaty or convention.

To obtain a Tax Residence certificate in the UK, please contact Maira Consult.